New WWBIC Impact Report

New WWBIC Impact Report

WWBIC: Making a difference. Results that matter.

Making a Difference Is What We Do

Every day at WWBIC, our social mission is to assist clients in improving their financial wellbeing.

Since 1987, WWBIC has advanced inclusive entrepreneurship by providing business lending and training support to underserved individuals – those “pre-rich” entrepreneurs who have great potential yet often struggle to access the capital and resources to make their business ownership dreams a reality.

Beginning in 2019, WWBIC undertook a third-party study to better understand the financial footprint of our business borrowers. This research analyzed data over a decade to better understand the long-term impact of our work in the aggregate: How WWBIC is making a difference in the lives and communities of the people we serve.

LOANS

Every dollar that WWBIC invests in a small business results in nearly $22 in economic activity.

- 2,593 direct jobs have been created and retained by WWBIC borrowers

- WWBIC’s current loan portfolio is roughly $23.5 million with 592 active borrowers

- WWBIC loans are directly and indirectly generating more than $174 million in annual economic activity

“The pandemic has [brought an] unfriendly future for small business, especially start-ups,” says WWBIC client Fanni Xie, owner of Uni Uni Tea Shop. “When life gives you lemons, don’t make lemonade – eat the lemon and take the seeds and plant them. WWBIC is the water and the sun I needed to plant my tree. I was able to get a $200,000 SBA start up loan and break down the barriers for me to become a business owner.”Click here for more details on WWBIC loans.

ENTREPRENEURSHIP TRAINING

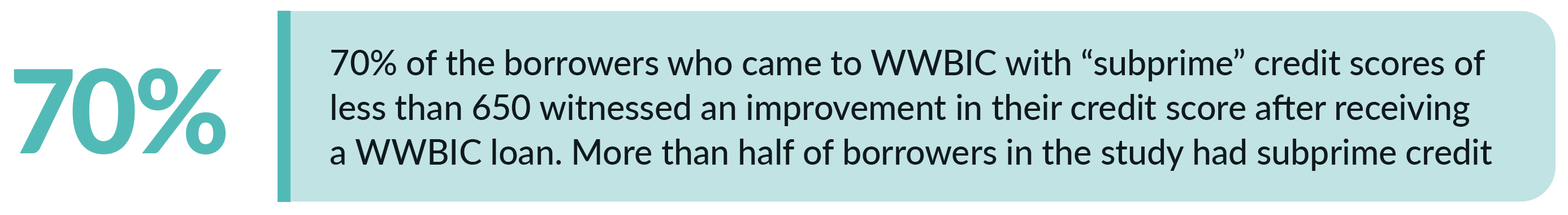

70% of borrowers who came to WWBIC with a subprime credit score witnessed an improvement in their credit score.

WWBIC doesn’t just provide lending capital to our small business clients, we also offer a variety of training sessions specifically designed to meet the needs of aspiring, new or growing entrepreneurs on topics ranging from business planning, cashflow, QuickBooks, and business certification to marketing, human resources and industry-specific training.

This training is offered at varying times during the week and on the weekend, in person or online, and most of it is provided for free to meet the needs of entrepreneurs. In addition, WWBIC provides specific services to military veteran business owners through our Veteran Business Outreach Centers (VBOC) programming and training specific to Spanish-speaking clients.

As a result, third party research shows that 70% of the borrowers who came to WWBIC with “subprime” credit scores of less than 650 witnessed an improvement in their credit score after receiving a WWBIC loan. More than half of borrowers in the study had subprime credit.

“WWBIC provides relatable financial classes and seminars. They helped increase our brand’s value, also making us more bankable.” says Angela Smith, WWBIC client and owner of Daddy’s Soul Food & Grille.

Click here for more details on WWBIC entrepreneurship training

COACHING

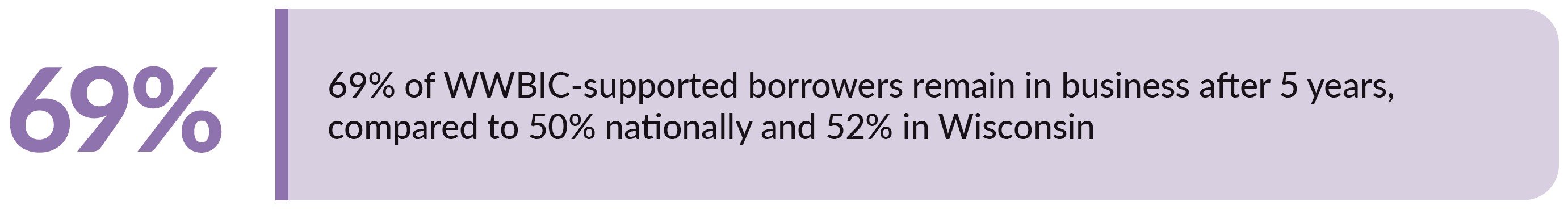

69% of WWBIC-supported borrowers remain in business after 5 years, compared to a 50% rate nationally.

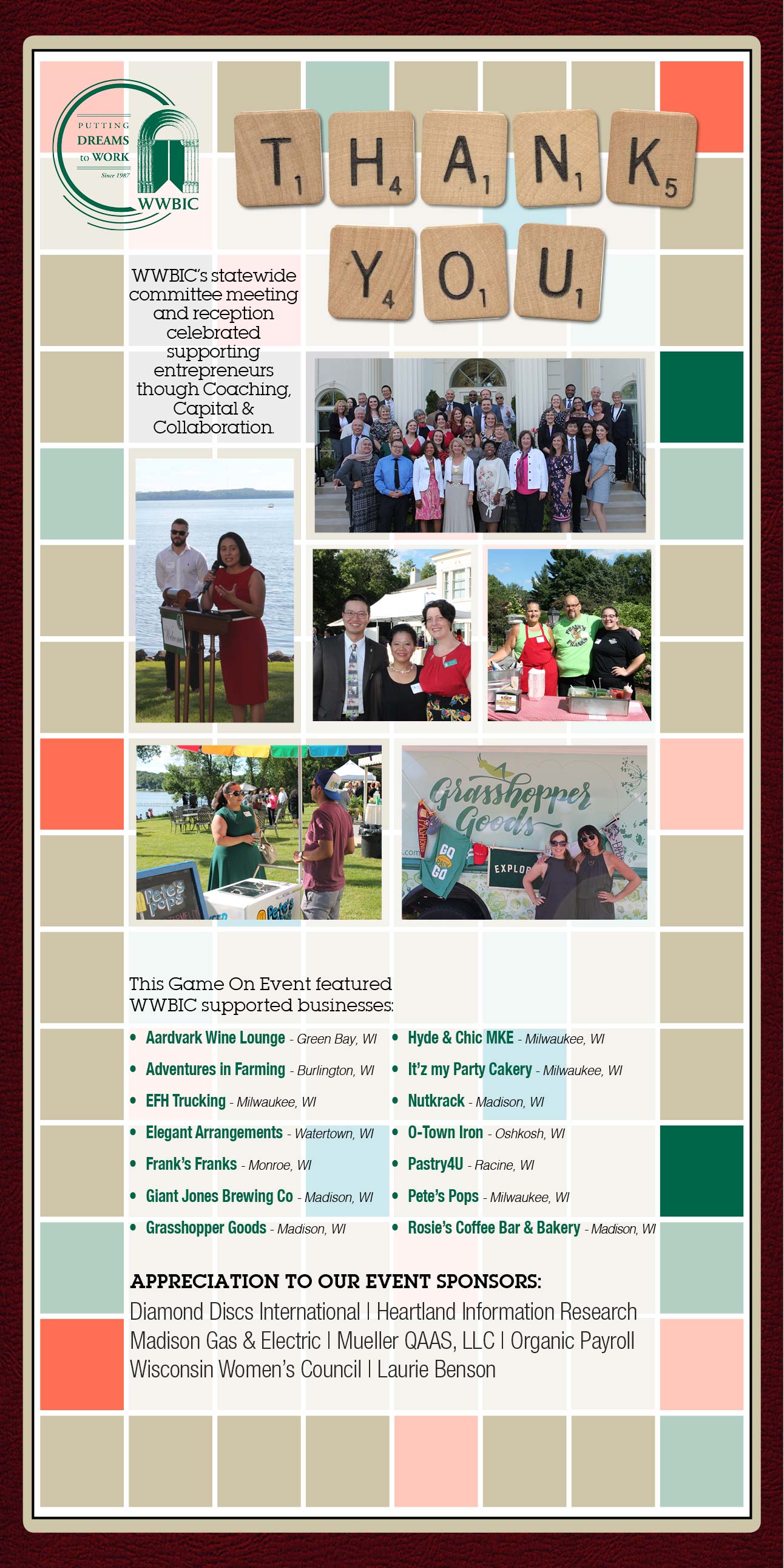

COACHING. CAPITAL. COLLABORATION.

We are proud of the way we sustain relationships with our clients. Our Small Business Consultants and professional volunteers provide ongoing support to WWBIC loan clients. In-depth business assistance for WWBIC borrowers ensures that business owners have access to the tools and skills they need to grow profitable and sustainable businesses.

Throughout the term of a loan we provide:

- Annual site visits & one-on-one coaching

- Promotional & networking opportunities

- Resource referral network

- 24/7 access to WWBIC’s Initiate Portal, an online business resource with over 100 tools, videos and guides

Our clients’ success is important to us and our Small Business Consultants are here to assist and build a relationship that truly benefits your business. As a result of this technical assistance built into all WWBIC loans, it’s not surprising that research shows that 69% of WWBIC-supported borrowers remain in business after 5 years, compared to only 50% nationally.

“WWBIC provides a multitude of resources to navigate through different crises,” says Brandon & Arielle Hawthorne, owners of Twisted Plants. “Whether it be the pandemic or insights on making sure our business succeeds, WWBIC has specialists and virtual assistance readily available.”.

Click here for more details on WWBIC’s ongoing business assistance.

FINANCIAL WELLNESS

53% of WWBIC clients with very poor credit improved their credit score

Encouraging Wisconsinites to lower their debt, increase their credit, and establish good spending and saving habits is also an important part of what we do. From free financial wellness courses like “Low Income? Level Up” and “The Power of Credit” and “Let’s Build Generational Wealth” to our popular “Make Your Money Talk” series co-sponsored by the Housing Authority of the City of Milwaukee, WWBIC is dedicated to teaching people how to better their financial situation.

Some of our financial wellness clients have dreams of starting their own business some day, but many are simply looking to purchase a vehicle or a house or finance their college education. Regardless of their financial goals, the end result is the same. Third party research shows that 53% of WWBIC clients with very poor credit improved their credit score, which is 14% better than the control group from the same research.

“Being a homeowner has always been a dream of mine,” says Monnike Brooks, a Make Your Money Talk program graduate. “The resources provided to me really set the tone to make this become a reality. In March of 2021, I closed on the house I now call home.”

Get more details on WWBIC’s financial wellness sessions here or find out about the Make Your Money Talk program here.

BREAKING DOWN BARRIERS

“I am where I am today because you stood at the door of opportunity and held it open for me.”

WWBIC opens the doors of opportunity by providing underserved individuals who are interested in starting, strengthening or expanding businesses with access to critical resources such as responsible financial products and quality business and financial training.

We focus on individuals who face barriers in accessing traditional financing or resources in pursuit of their dreams and economic well-being – in particular women, people of color, veterans, rural and lower wealth individuals.

Every day we work hard to achieve our social goal of improving the economic well-being of individuals by advancing inclusive entrepreneurship and facilitating self-sufficiency strategies.

“I am where I am today because you stood at the door of opportunity and held it open for me,” says WWBIC client and owner of GSI General Contracting, Benjamin Clark. “I have always stressed to my peers how you assisted me and GSI over the years.”

Click here for details on WWBIC’s new Black Business Boost program funded by PNC Bank.

OUR WORK FORWARD

WWBIC’s work is not done. Our march continues.

While we have moved the needle for many, WWBIC’s work is not done. Our march continues.

Access to fair and responsible capital continues to be a struggle for many entrepreneurs and small business owners, especially those with subprime credit scores or lack of assets. This analysis of WWBIC’s outcomes, coupled with our own analytics and client testimonials, demonstrate that WWBIC’s work is making strides in bolstering the economic vitality of low-income and underserved entrepreneurs and in our local communities.

So what’s next for WWBIC? Click here for details on our 2022-2025 strategic plan.

$23.5 million — Current WWBIC Loan Portfolio

Active WWBIC Borrowers

Direct jobs created and retained by WWBIC borrowers

$174.2 million — Annual economic activity directly and indirectly generated as a result of WWBIC loans

HOW YOU CAN HELP

In 2022, WWBIC is celebrating 35 years of impact in Wisconsin and beyond. We are 35 and thriving, with 70 employees and an ever-growing loan portfolio and program offerings. How can you help ensure our success now and into the future?

Shop Small

Use our online client directory or browse our Shop Small Catalog to find WWBIC clients. Support them by giving them your business!

Volunteer

WWBIC’s network of over 400 volunteers are integral to assisting our clients and supporting our work. No matter what your area of expertise, you can help! If you have a passion for serving your community and believe entrepreneurs could benefit from your knowledge, please complete a Volunteer Application and reach out to learn more today!

Donate

Although our mission is to serve entrepreneurs, WWBIC itself is a non-profit organization. Consider making a tax-deductible donation directly to WWBIC. Get more details on our Donations page.

Work for Us

WWBIC is hiring! Find out about positions currently available here.