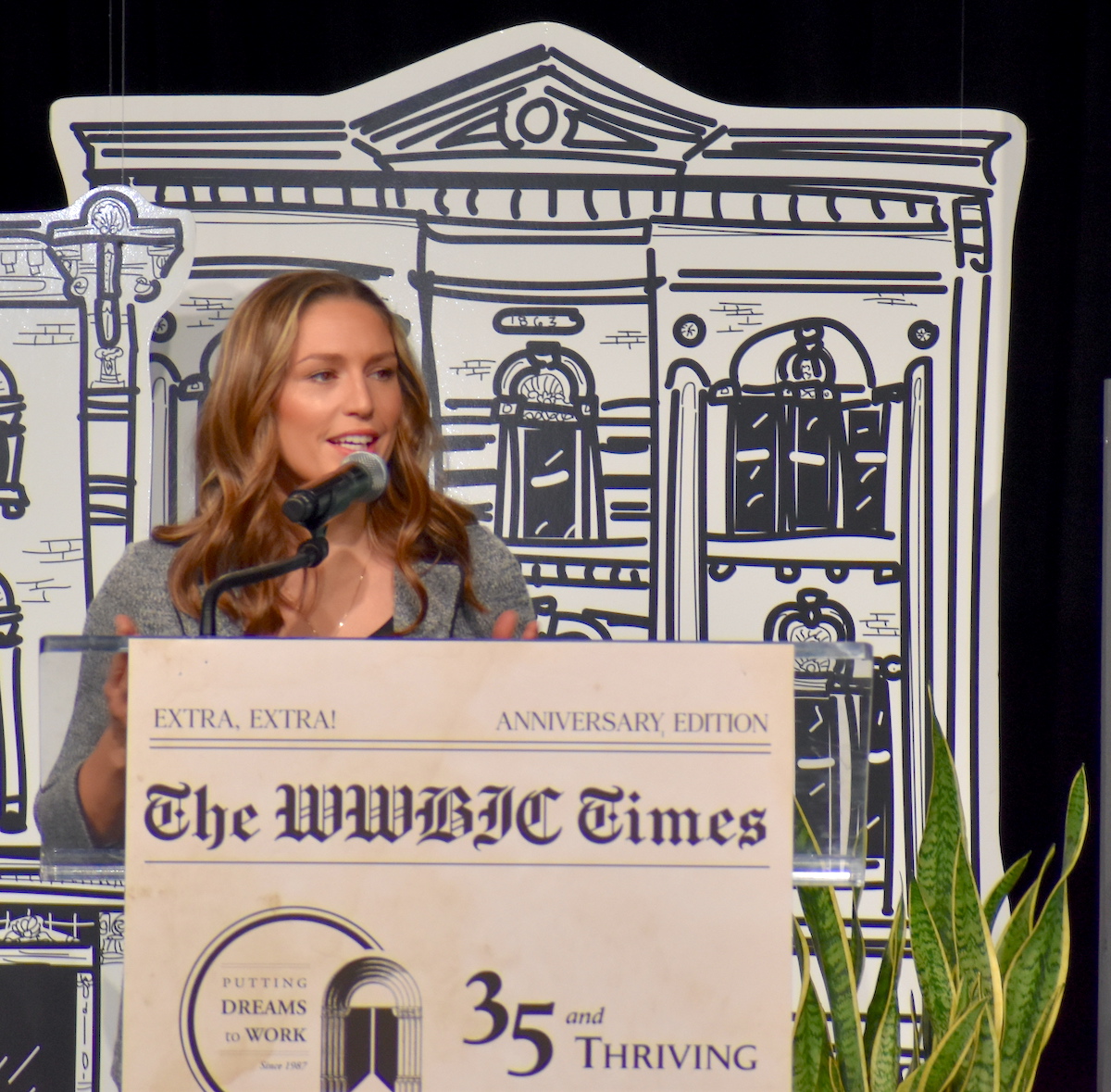

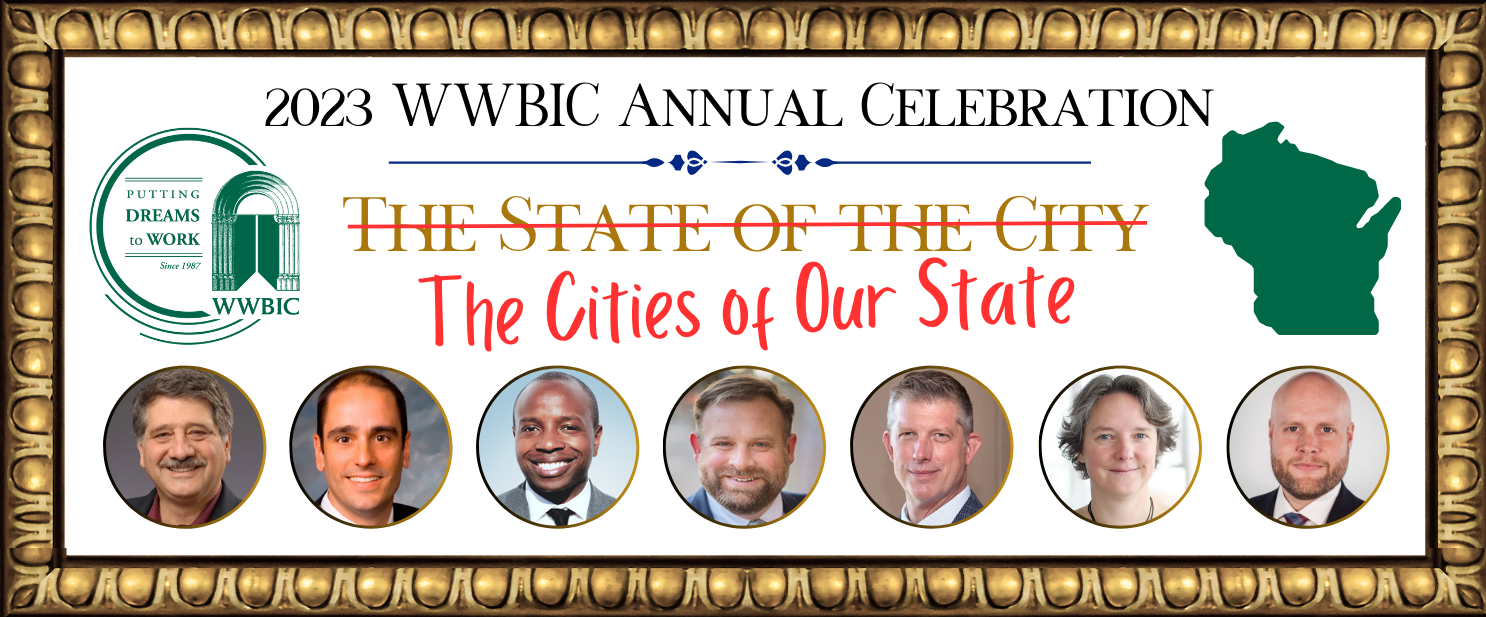

2023 WWBIC Luncheon Highlights

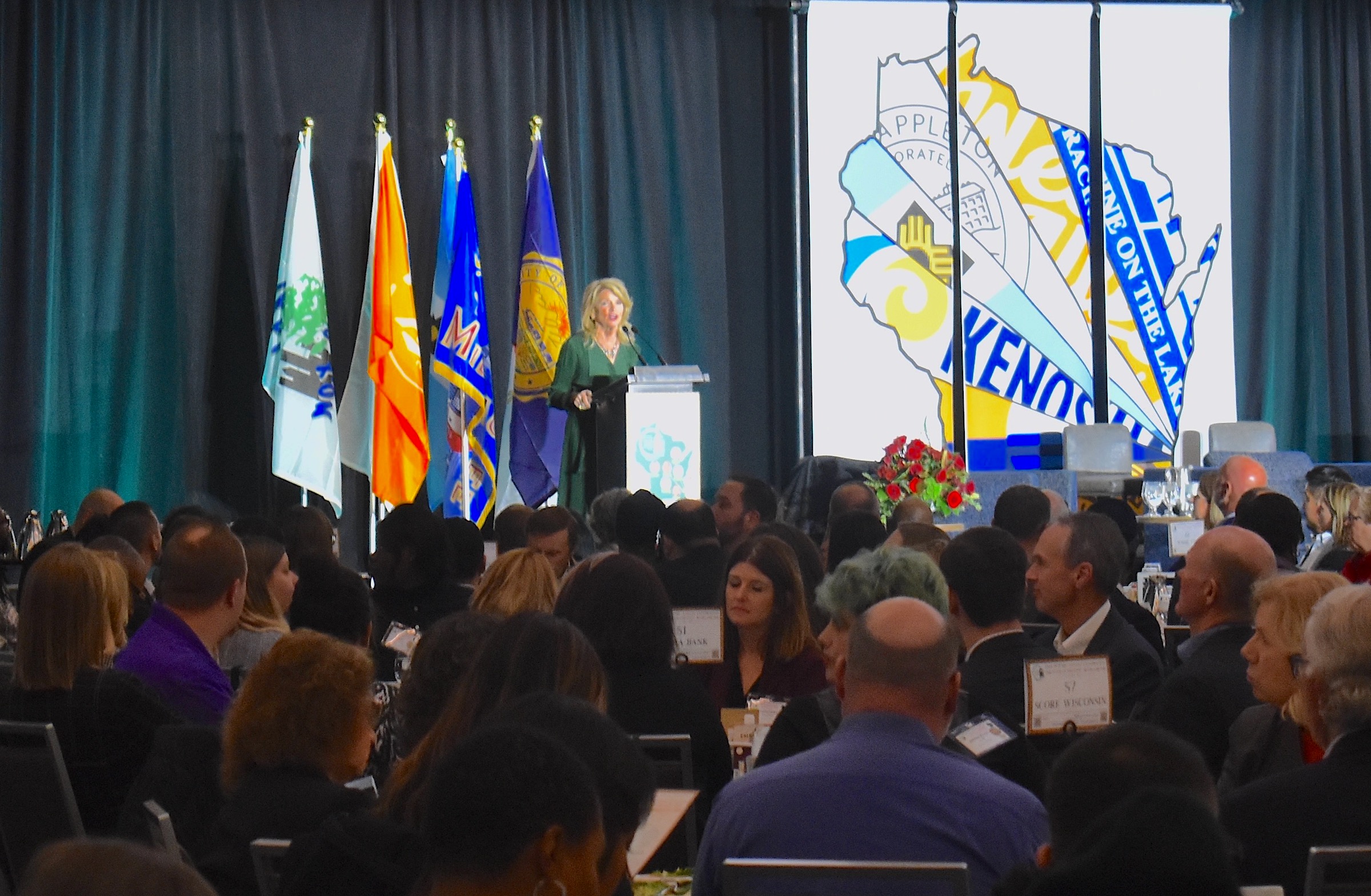

WWBIC extends a sincere thank you to the over 1000 attendees who made our 2023 annual luncheon a resounding success! Clients, funders, partners, volunteers, staff and friends all gathered at the Brookfield Conference Center on November 28th to honor “The Cities of Our State.”

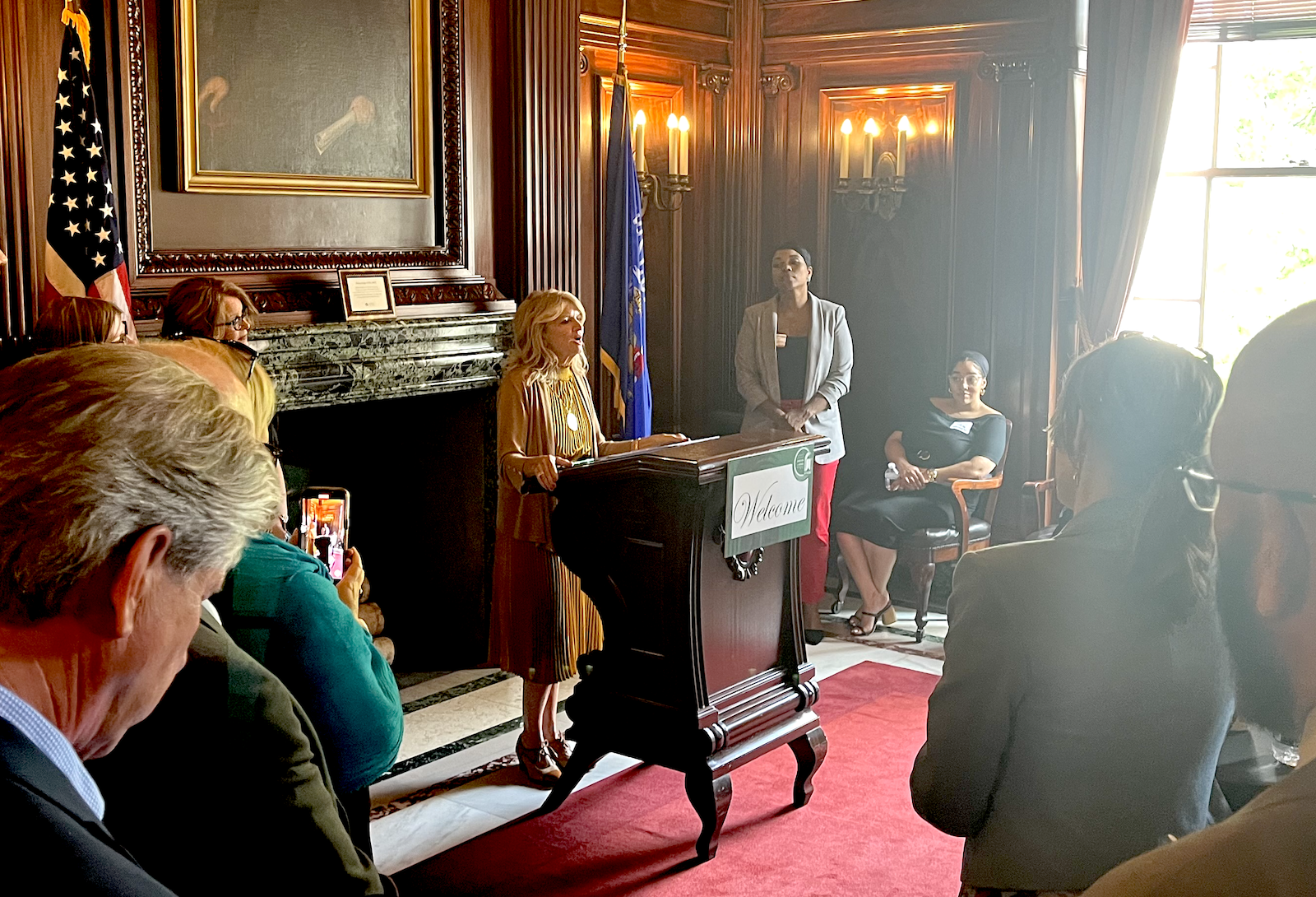

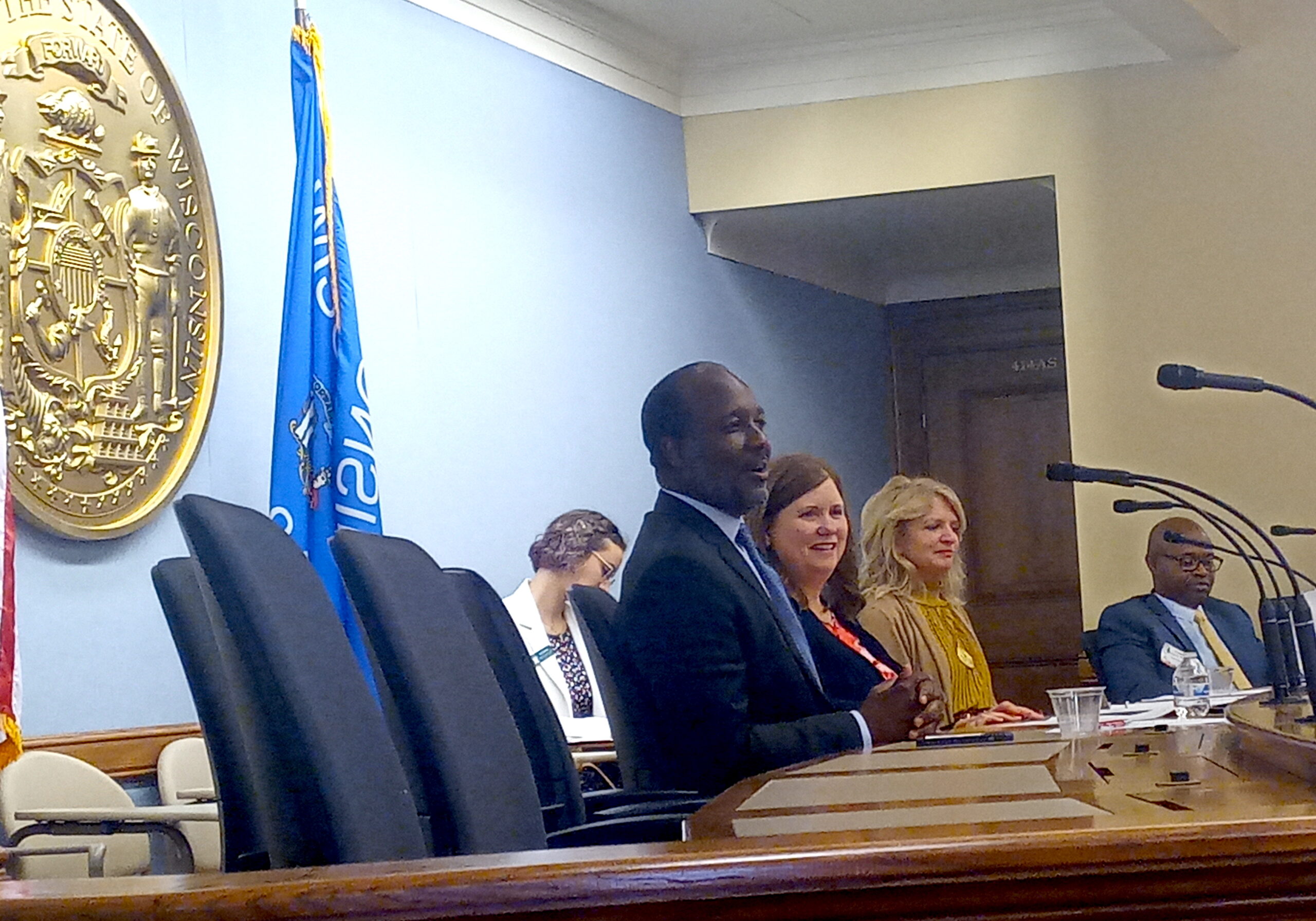

At the centerpiece of this theme, WWBIC presented a panel of seven mayors from across the state: John Antaramian of Kenosha, Dan Devine of West Allis, Cavalier Johnson of Milwaukee, Cory Mason of Racine, Mitch Reynolds of La Crosse, Satya Rhodes-Conway of Madison and Jake Woodford of Appleton. These leaders openly discussed the state of small business in their communities with emcee Mary Stoker Smith of Fox 6 Milwaukee. Before and after the luncheon, over 80 entrepreneurial clients showcased their products in the Small Biz Market. Centerpieces, coffee and desserts featuring WWBIC clients were also shared with attendees.

Follow the links provided on this page for a video of the luncheon and Fox 6 video clips from the Small Biz Market, or click here to see event coverage from the Milwaukee Business Journal.

Click on the link above for a video of the full program from the 2023 WWBIC Annual Luncheon.

Special thanks to Brian Kramp and the team at Fox 6 Milwaukee for covering our Small Biz Market the morning of the event. See our clients in these segments on the Wake Up show and Real Milwaukee show.

View an interactive list of all our sponsors here