WWBIC Invest in Business Grant

PLEASE NOTE: WWBIC is no longer accepting applications for the Invest in Business Grant. We are oversubscribed with applicants for consideration. Funding can only support 300-400 businesses and we have received over 1,200 applications. We hope to be a resource partner for you in the long term, matching resources with your needs. Thank you for your understanding.

WWBIC’s Invest in Business Grant is available to support diverse Wisconsin businesses including those in underserved communities or other areas disproportionately affected by the COVID-19 pandemic. $3,000,000 in total will be distributed with individual grants available based on need up to $10,000.

The Grant will assist eligible diverse micro and small businesses in both urban and rural communities with sustainability, and growth; further advancing capital across Wisconsin.

Since 1987, WWBIC has served as the leading innovative economic development corporation that is “Putting Dreams to Work” by assisting micro enterprise and small businesses throughout the 72 counties in Wisconsin. We open the doors of opportunity by providing underserved individuals who are interested in starting, strengthening or expanding businesses with access to critical resources such as responsible financial products and quality business and personal financial training. WWBIC focuses on individuals who face barriers in accessing business financing and training support, including women, people of color, veterans, rural residents, and lower-wealth individuals.

As a culturally effective organization, WWBIC strives to improve the economic well-being of underserved individuals by advancing inclusive entrepreneurship and facilitating self-sufficiency strategies.

Diverse Business*

Businesses owned by individuals from communities that have in the past been denied access to capital or who have been underbanked

*Source: Wisconsin Department of Administration

Grant

- Grants up to $10,000 based on need are available

- $3 million in aggregate grants will be awarded

WWBIC reserves the right to negotiate, limit, or amend awards according to the program’s objectives.

Eligibility

- Business owner is a documented WWBIC client that utilized WWBIC services in 2020, 2021 or 2022 (including those trained, counseled, received loan/grant or services through a WWBIC initiative such as and including Kiva, Mercado, Black Business Boost or VBOC)

- Business has sustained negative financial impact due to COVID-19

- Business is located in Wisconsin and the owner participates in the day-to-day operations of the business

- Business is a for-profit

- Business needs to be in good standing with the State of Wisconsin and current on all local, state and federal taxes

- Business needs to be open and operational with revenue generation since 2021. Supporting tax documentation is required. (If business was started in 2022 or 2023 you are not eligible to apply)

- Business needs to have all necessary permits, licenses, certificates or other approval, governmental or otherwise, necessary to operate its business and own and use its assets

- Business needs to not be listed on the State of Wisconsin Ineligible Vendors Directory or listed on the Wisconsin Department of Transportation Listing of Debarred, Suspended and Ineligible Contractors

- Grant use of funds is nonduplicative and business cannot obtain other funding for the same expense

Note: The Invest in Business Grant is a stand-alone product, it does not need to be coupled with a loan

Eligible Use of Funds

- Payroll/Benefits

- Lease/Mortgage/Incubator Payment

- Leasehold Improvements

- Equipment Purchase, Inventory, or Supplies

- Marketing

- Other Working Capital

Note: Grants cannot be used for personal expenses

Application

|

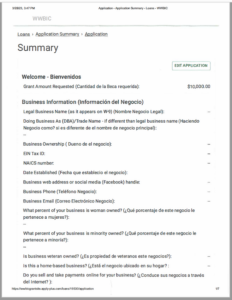

WWBIC’s Invest in Business Grant application link will be shared through Constant Contact in English and Spanish at 8:00 am Wednesday, April 5th, 2023. WWBIC is sharing this information with clients who utilized WWBIC services in 2020, 2021 and/or 2022. Not all who receive this information will be eligible for funding, but we want to share it with our clients that we served during the pandemic for your review. The application will be online, and applicants will need to register and apply through WWBIC’s financing platform Apply+ to complete an application. Applications will be accepted from April 5-19, 2023. Within the application applicants must share information on their business, business owners, employees, business challenges, grant use of funds, and information on other financing you received during the pandemic. The application is best completed on a computer as document uploads are required. The application will take roughly 20 minutes to complete. Documents required in application include:

Note: Documents submitted must include your business name If help is needed for another language or disability please reach out to Lisa Sullivan, lsullivan@wwbic.com and we will do our best to make accommodations for an interpreter or other aid with an appointment within the application period. |

View video with

View questions that will be on the application |

Timeline

Applications will be reviewed in the order they are received and will be equitably considered based on program goals. WWBIC’s goal is to award grants and process the one-time disbursement as expeditiously as possible. Processing will be continual until grant funds are expended.

Note: We expect being oversubscribed with applications for consideration and will communicate via email with all applicants when the application closes to share details on number of applications received the review process, expected timeline and supporting documentation needed to issue the grants

Award Disbursement Requirements

As applications are reviewed businesses meeting the requirements will be contacted to provide additional documentation.

- Businesses will need to provide updated employee information forms for themselves and their business employees

- Note: As a nonprofit, WWBIC must obtain data on our clients and businesses served to measure impact of our services

- Business will need to attest if awarded this grant, that they have not received funding for the same expense from another funding source.

- Business needs to agree to supply receipts/documentation to WWBIC as soon as possible, no later than 3 months, after receiving the grant funds to substantiate their expenses for their use of funds.

- Business needs to agree to have grant funds deposited electronically via ACH in their business bank account; W9 and ACH Business Banking information will be needed.

- Business needs to acknowledge that acceptance of grant funding could have tax implications; please consult your tax advisor. Recipients will receive 1099 documents reflecting their grant award.

- Owner will need to provide a copy of a photo ID and proof of business ownership (operating agreement, bylaws or sole member affidavit)

Please note: If business is unresponsive after several contact attempts or unable to supply needed documentation within a 14-day period they voluntarily remove themselves from award consideration.

This project is being supported, in whole or in part, by federal award number SLFRP0135 awarded to the Wisconsin Women’s Business Initiative Corporation (WWBIC) via the Wisconsin Department of Administration by the U.S. Department of the Treasury.

Questions?

Lisa Sullivan, Program Manager

Lisa.sullivan@wwbic.com

414.395.4544