Join Us! WWBIC Annual Fundraiser Luncheon to support small business

Join Us! WWBIC Annual Fundraiser Luncheon to support small business

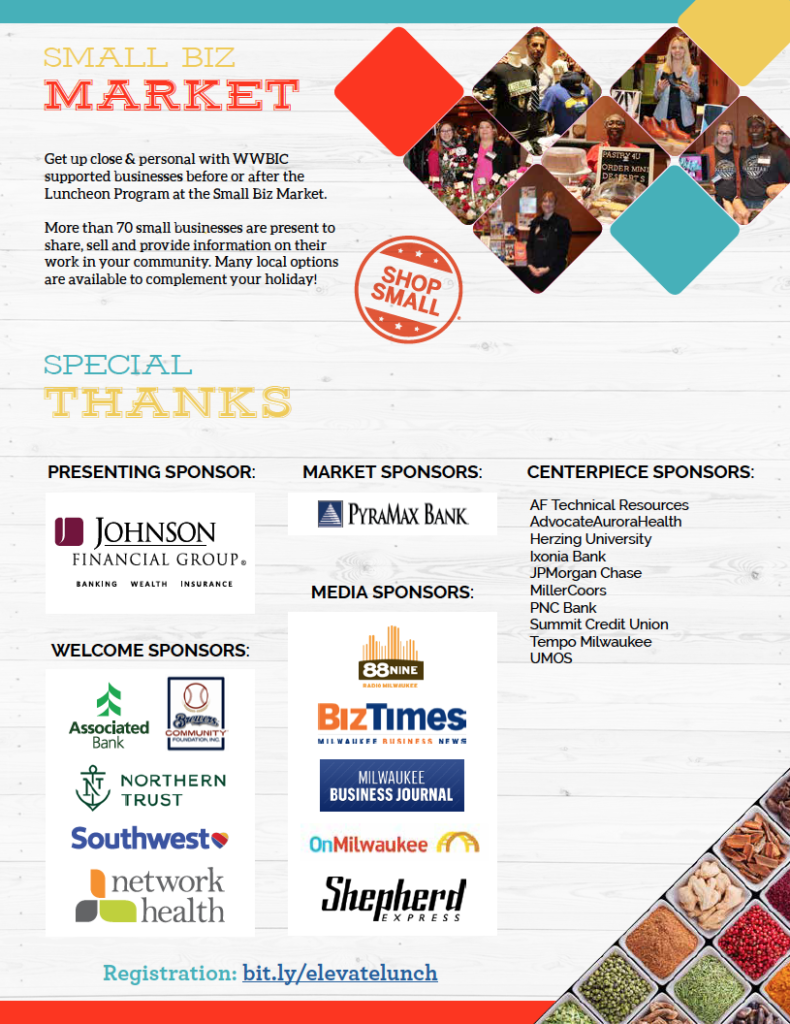

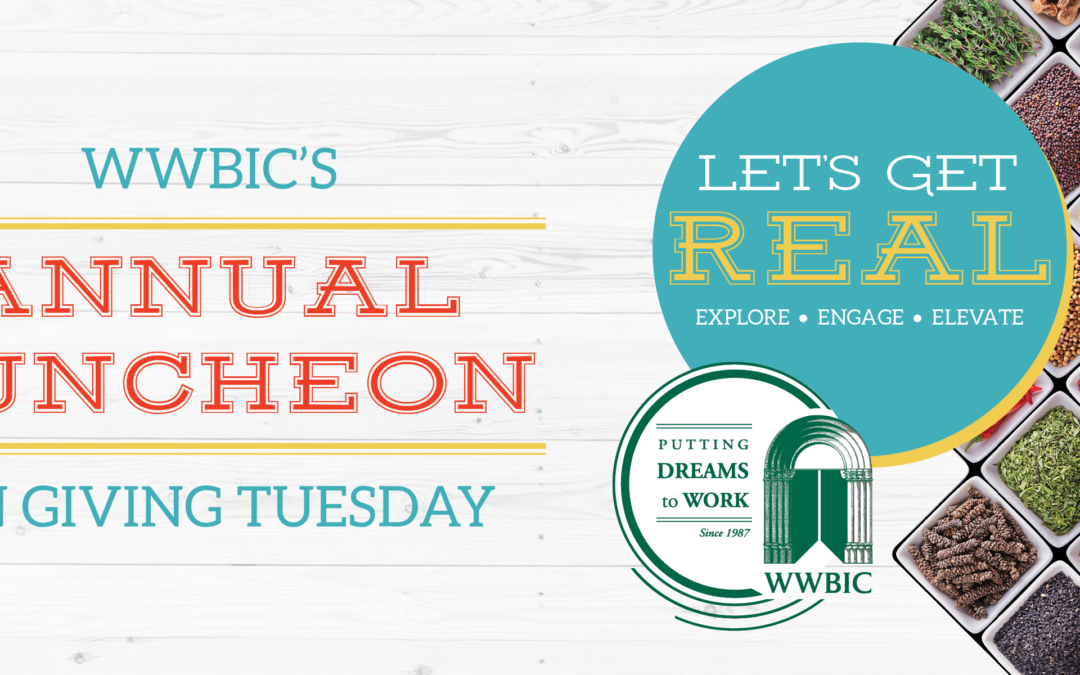

Save the Date for WWBIC’s 2019 Annual Luncheon on December 3rd at the Potawatomi Hotel & Casino in Milwaukee.

This year our luncheon embraces the theme: Let’s Get Real: Explore. Engage. Elevate. On “Giving Tuesday”, WWBIC will celebrate our local heroes: business owners and their small, independent businesses that bring vibrancy, creativity and innovation to our communities. This year we welcome, Mike Colameco as our keynote speaker. Mike has developed a long and storied career in the food and beverage industry … exploring, engaging and enhancing that which nourishes us. We look forward to his insight!

Colameco is a professionally trained chef, author, radio, and TV host. He graduated from the Culinary Institute of America and shared his talents with New York’s noted Four Season’s Restaurant, Windows on the World, Tavern on the Green and The Ritz Carlton. In the late 80’s early 90’s his local community Cape Town, New Jersey was home to his restaurant, The Globe. This rich background as a chef lead him to a successful career in food media: as an author with Mike Colameco’s Food Lover’s Guide to New York City, as a host/producer of the radio show Food Talk, and as a host/producer of Mike Colameco’s Real Food. Since it launched in 2000, Mike Colameco’s Real Food on PBS’ Create TV has been a popular, enduring, documentary style show sharing a real chef’s point of view at how the most influential people in today’s restaurant world are transforming the way we think about food.

Let’s Get Real roots itself in the interpersonal experiences and creative talents small business brings to our communities. When we explore, when we engage, we have the ability to elevate. Here at WWBIC we elevate our communities’ one small business at a time. As they say… many hands make light work. We invite you to join us so WWBIC can continue to match resources and needs supporting Wisconsin’s entrepreneurial community.

This year’s WWBIC’s Luncheon will showcase: WWBIC’s impact in urban and rural Wisconsin; independent, locally owned businesses; food and restaurant businesses; our food heritage, our family farms and the beauty new Americans bring in sharing their cultures.

To register, please click here.

For information on Sponsorship Levels and Benefits, please click here.