The City of Oshkosh Micro Enterprise Program (Forgivable Loan)

The Oshkosh Micro Enterprise Program is focused on existing micro enterprises located in the corporate limits of the City of Oshkosh that have been impacted by the COVID-19 pandemic.

This is a forgivable loan program and qualified micro enterprises are eligible for a forgivable loan of up to $7,500. Funding can be used for assistance with, basic working capital for leasing space, insurance and/or utilities, and staff salaries.

Please download the appropriate fact sheet for your location to view income requirements for this opportunity. To view a detailed map of eligible locations, please click here.

How will this program work and who is eligible?

WWBIC will be handling the application and distribution of the loans, as well as follow up business coaching and mentorship opportunities. Funds will be targeted to for-profit, existing micro-enterprises located in the City of Oshkosh, where the business has five or fewer full-time equivalent employees, including the owner.

Eligibility:

- Businesses must be in the City of Oshkosh.

- Businesses must be a Micro Enterprise. (5 or fewer employees including the owner(s))

- Business needs to be in good standing with State of WI and City of Oshkosh.

- Business must have a DUNS Number

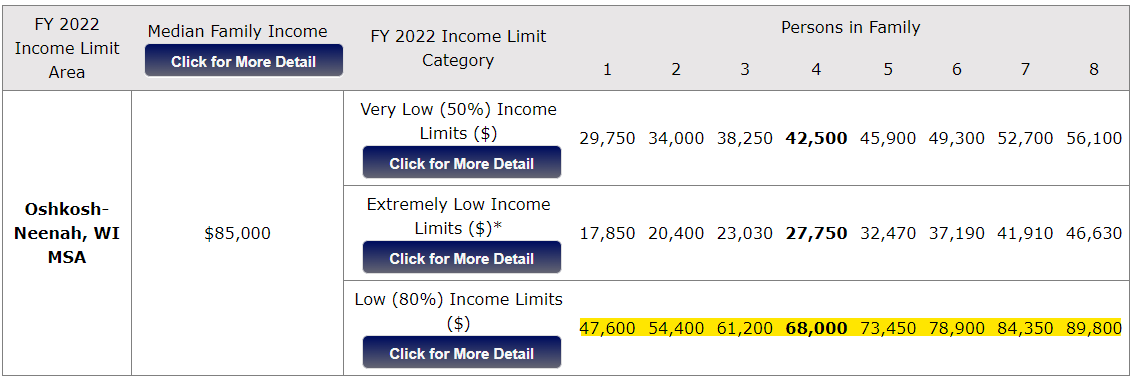

- Business owner’s household income is under 80% of the County of Winnebago Median

- EXCLUDES new businesses started after February 1st, 2020

What type of documentation is required?

Businesses must provide all documents to be considered for the forgivable loan below:

- Executive Summary for the forgivable loan and detailed use of funds for your business

- Client Information Form

- Business Information Form

- Duplication of Benefits Form

- EIN

- Business Debt Schedule

- Interim Income Statement (2022)

- Business Tax Returns for 2020 and 2021 – two separate PDFs

- SBA Form 413 – Personal Financial Statement for all owners of the business, including spouses and guarantors

- Personal Tax Forms for 2020 and 2021

- W-2 or 1099 for 2021

- A copy of your driver’s license/photo id

Ineligible Use of Funds

You may not use your loan for the following below items below:

- Reimburse expenses incurred prior to Feb 1, 2021

- Pay off non-business debt

- Purchase personal expenses

- Direct financing to political activities or paying off taxes and fines

- Purchase personal items, or support other businesses in which the borrower may have an interest

- No new business start up costs

When will the application be available?

The application will remain open until all Forgivable Loan funds have been exhausted. Applications will be reviewed in the order they are received (time stamped) and will be equitably considered.

For additional information or questions about applying for The Oshkosh Micro Enterprise Program, please contact Colleen Bies, at cbies@wwbic.com.