The Wisconsin Women’s Business Initiative Corporation (WWBIC) has received funding from Calumet County CDBG allocations to launch the Resiliency Grant for NE WI Rural Microenterprises to assist small and micro business owners whose business has been negatively impacted by the COVID-19 pandemic/economic crisis.

Calumet County has approved $780,000 for small business assistance grants. These grants will range from $6,000 to $12,000 to each business. Grants can be used for assistance with, but not limited to, past due payroll, rent, lease or utility payments, business supplies, inventory, business operating expenses.

Ineligible uses include construction of interior or exterior property as well as other non-COVID related business debt.

How will this program work and who is eligible?

WWBIC will be handling the application and distribution of the grants, as well as follow up technical assistance such as business coaching and mentorship opportunities. Additional information on this funding opportunity can be found here: bit.ly/neresiliencygrants.

Funds will be targeted to for-profit, existing small businesses (not start-up) located in Calumet and Outagamie County, City of Menasha, City of New London, and Village of Fox Crossing. EXCLUDES City of Appleton.

Business has 5 or fewer employees, including the owner.

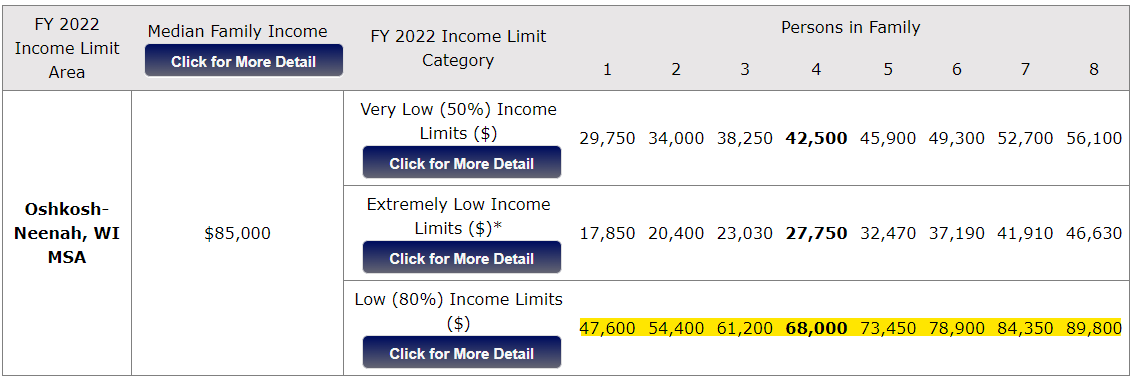

Business must meet low-to-moderate income qualifications for their respective county.

Business must be able to document how the business has been adversely impacted by the COVID-19 pandemic. Interested small business owners, please review all requirements for eligibility and all documents needed for the application at: bit.ly/neresiliencygrants.

When will the application be available?

The application will be available on Wednesday, July 14 2021 at noon. All applications will be reviewed in the order they are received (time stamped) and will be equitably considered. The application will remain open until noon on Friday July 30, 2021.

Priority period: July 14 – July 16.

WWBIC will accept applications from all eligible applicants, but only process and fund priority group applications during the priority period. Women owned, Veteran Owned, Socially disadvantaged individual and economically disadvantaged individuals.

For additional information or questions about applying for the Resiliency Grant for NE WI Rural Microenterprises, please contact Colleen Bies, Regional Project Director, at cbies@wwbic.com or 920-944-2710.

According to Mary Kohrell, Calumet County’s Economic Development Director, “we know there are many businesses in our service region that are still feeling the affects of COVID-19, especially the smallest of the small businesses. I’m so excited to get these grants out to our qualifying businesses, and WWBIC has the perfect team to make it happen!”

“We know that we can accomplish much more collectively through partnerships, and thus WWBIC is grateful to have such a relationship with Outagamie and Calumet Counties to advance dollars to our rural communities. Small businesses are the heart of our economy and these dollars will help leverage the recovery efforts that are needed now more than ever to assist with resiliency and sustainability to our small businesses,” said Kamaljit Jackson, Vice President for Programs and Operations.