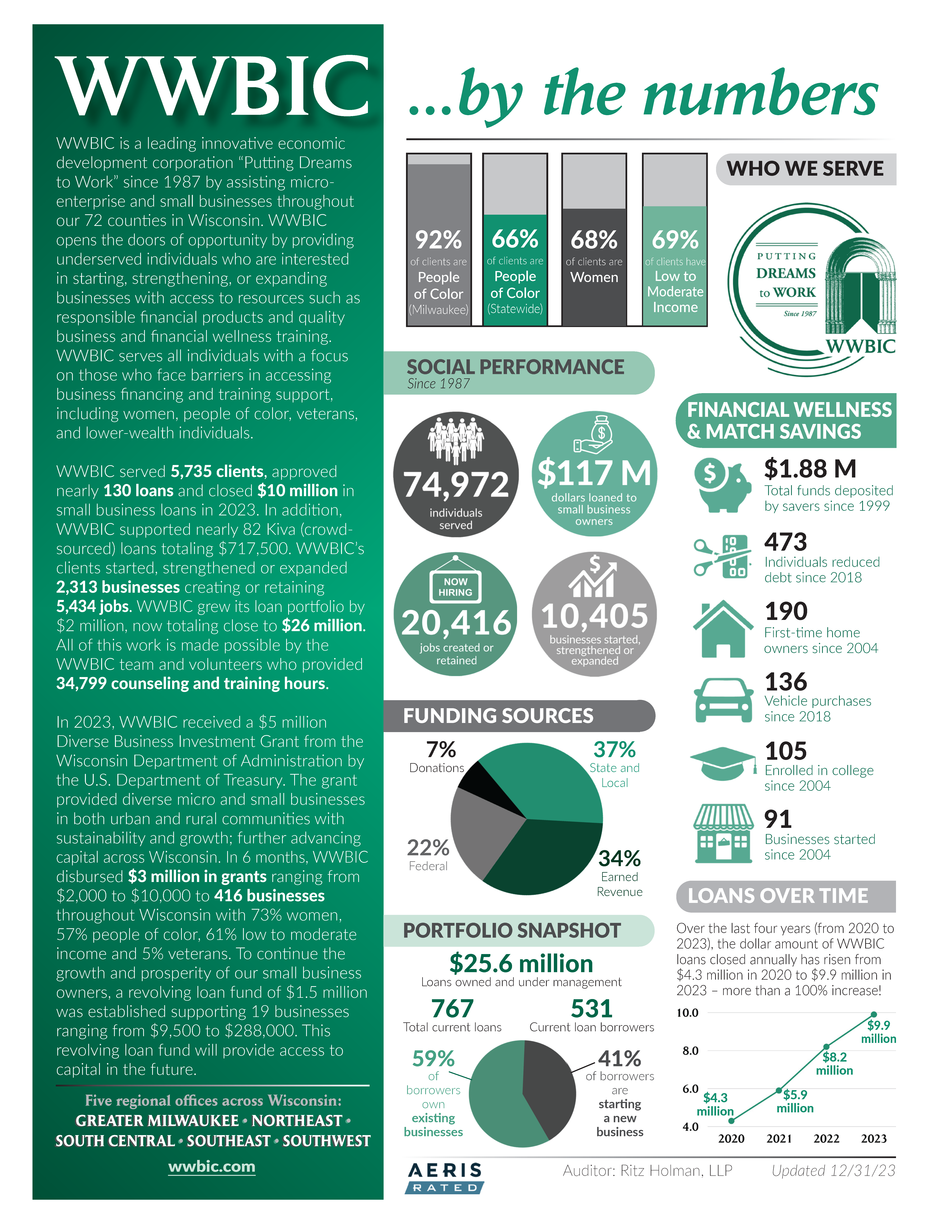

Statistics and Stories of Success

Life is a journey, not a destination.

Find out more about who WWBIC is, who we serve, our 2023 accomplishments and our cumulative service statistics. Click on the WWBIC: By the Numbers image shown here for details.

Nobody tells the story of WWBIC’s impact better than the clients we have worked with over the years. Please enjoy their journeys and learn from their experiences.

Click on the client names below to read their stories.